China to take steps to improve bad faith deterrent mechanism

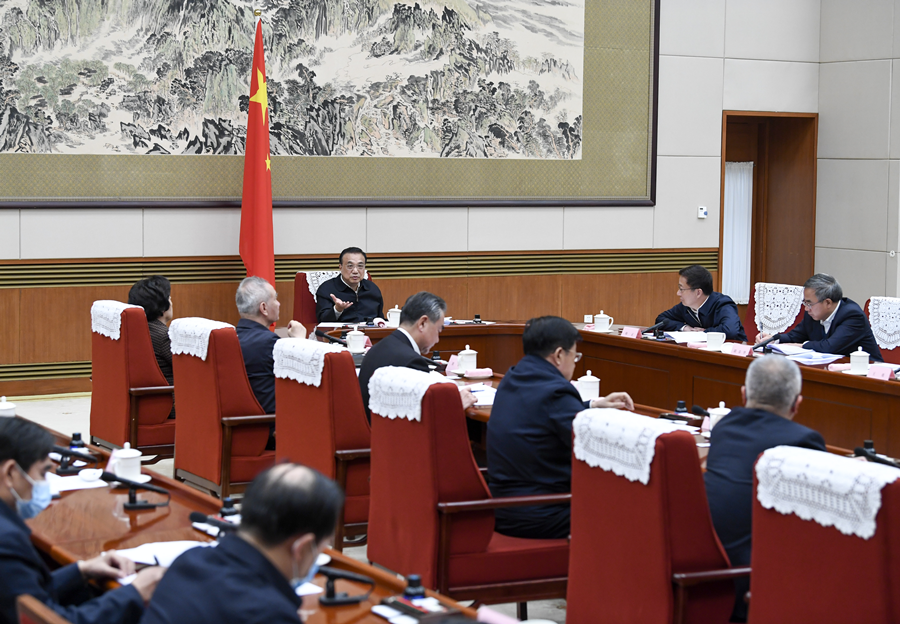

China will adopt policy steps to optimize the mechanism for deterring acts of bad faith and refine the social credit system to underpin the development of the socialist market economy, the State Council's executive meeting chaired by Premier Li Keqiang decided on Wednesday.

"In recent years, China's social credit system has continued to develop. A market economy relies on credit, and a credit-based economy must follow the rule of law. Work in this regard shall be effectively carried out pursuant to laws and regulations," Li said.

Those at the Wednesday meeting decided on measures to refine the bad-faith deterrent mechanism to promote the orderly and healthy development of the social credit system. The principles include adhering to laws and regulations, protecting rights and interests, taking a prudent and appropriate approach and implementing list-based management.

The scope and procedures of credit information shall be formulated in a science-based way. Including certain behaviors in public credit information will require strictly following laws and regulations and a catalog management approach. Such information will be made accessible to the public.

Administrative departments must determine acts of bad faith on the basis of legally binding documents. The scope and procedures for sharing credit information shall be standardized. The principle of legality and necessity shall be observed when deciding whether and to what extent credit information is shared and disclosed. Such decisions shall be made clear when compiling the credit information catalog.

The meeting underlined the need to strengthen information security and privacy protection. Access to and procedures for credit information inquiries shall be strictly enforced. Leaking, tampering, damaging or stealing credit information or utilizing credit information for personal gains will be seriously investigated and dealt with. Illegal collection and transaction of credit information will be strictly cracked down on.

"In the development of the social credit system, it is important to pay attention to protecting personal privacy and trade secrets. Credit reference shall be conducted in accordance with law, with science-based scope and definition and appropriate penalties. Information must be used in a safe and secure manner," Li said.

Identification of list of entities with serious acts of bad faith will be better regulated. The list shall be limited to those who put public health and safety in grave jeopardy, seriously sabotage the fair market competition order or disrupt normal social order. The list shall not be willfully expanded without authorization.

Punishment against bad-faith acts shall be enforced in accordance with laws and regulations, to make sure that penalties are meted out commensurate with dishonest behaviors. Disciplinary measures taken against entities with serious dishonest behaviors that reduce their rights or increase their duties shall be based on facts of bad faith and on laws and regulations. Punishments should be appropriate and not be added or increased at will. Financial institutions, credit service agencies, industry associations, chambers of commerce and news media should not be forced to punish entities with serious acts of bad faith.

A credit repair mechanism, which is conducive to self-correction, will be established. Entities will be allowed to fix negative credit records, unless otherwise stipulated by laws and regulations, should they correct dishonest behaviors and eliminate adverse impact. Relevant departments shall remove entities, who meet credit repair eligibility, from the list in a timely manner.

All localities and relevant departments shall promptly overhaul measures that have been rolled out for the determination, recording, disclosure and punishment of bad-faith acts, and those that do not meet the requirements shall be regulated in a timely manner.

The meeting also decided on measures to advance high-quality development of the credit reference sector. Cross-sectoral and cross-regional connectivity of credit information involving finance, government affairs, and public services will be promoted as provided by law. Disclosure and orderly utilization of data in government departments will be promoted in faster pace.

Market access of individual credit reference agencies will be promoted in an active yet prudent manner, and openness of the credit reference sector will be scaled up. Matching regulations and supporting institutions for the credit reference sector shall be improved and accountability mechanism strengthened. Fraudulent credit rating shall be strictly punished according to law.