What's behind China's robust FDI this year?

-- China posted faster growth in foreign direct investment (FDI) this year, with a growing appeal thanks to its steady recovery despite a COVID-19-induced global economic slowdown.

-- While the pandemic interrupted the global economy and trade, China has defied the trends of a worldwide investment slump and posted stellar growth.

-- China's mega-market volume, policy dividends, and improved business environment also win over the long-term investment commitment from multinationals.

-- The Latest forecasts of China's economic growth for 2022 from major international organizations have manifested their confidence in its economy.

BEIJING, Dec. 23 (Xinhua) -- China posted faster growth in foreign direct investment (FDI) this year, with a growing appeal thanks to its steady recovery despite a COVID-19-induced global economic slowdown.

In the first 11 months of the year, FDI into the Chinese mainland, in actual use, surged 15.9 percent year on year, crossing a remarkable line to reach 1.04 trillion yuan or 157.2 billion U.S. dollars, according to the Ministry of Commerce.

The 11-month figure has already outnumbered that for the whole of 2020. The entire year figure for 2021 will likely achieve double-digit growth, rarely seen in recent years.

The foreign capital inflow is widely seen as a window to observe a country's opening-up level and reflects its economic vitality. FDI flows react more strongly to crises than trade and gross domestic products (GDP), the United Nations Conference on Trade and Development said in a report.

"Foreign capital would flow to wherever the market flourishes and opportunities thrive," said Liu Xiangdong, a researcher with the China Center for International Economic Exchanges. He pointed out that China's stable economic performance and promising prospects were the underlying reason behind the impressive capital inflows.

Aerial photo taken on Dec. 18, 2021 shows a container ship by the Pacific international container terminal at the Tianjin Port of north China's Tianjin Municipality. (Xinhua/Zhao Zishuo)

Aerial photo taken on Dec. 18, 2021 shows a container ship by the Pacific international container terminal at the Tianjin Port of north China's Tianjin Municipality. (Xinhua/Zhao Zishuo)

STABLE ECONOMIC PERFORMANCE

While the pandemic interrupted the global economy and trade, China has defied the trends of a worldwide investment slump and posted stellar growth.

In the first three quarters, the country logged a 9.8-percent GDP expansion, well above its annual growth target of over 6 percent, data from the National Bureau of Statistics (NBS) shows.

Multinational companies have galloped to pump their cash into the Chinese market as the country's recovery gained steam partly thanks to its effective pandemic response.

November economic data showed that the "real sector" of China's economy registered solid expansion. The value-added output for major companies in the manufacturing sector witnessed accelerated growth, while high-tech industries saw rapid growth.

The production of industrial robots in November jumped 27.9 percent year on year, while the output of new energy vehicles surged 112 percent from a year ago.

"The real economy continued to strengthen, and positive changes have gradually increased," said Fu Linghui, an NBS spokesperson.

The country has overcome the negative impacts of the virus and leveraged its advantages in complete supply chains and sound foundation of the manufacturing industry, filling the gap between global supply and demand, said Ren Hongbin, vice minister of commerce.

Workers assemble new energy vehicles at an automobile company in Liuzhou, south China's Guangxi Zhuang Autonomous Region, Aug. 12, 2021. (Photo by Li Hanchi/Xinhua)

Workers assemble new energy vehicles at an automobile company in Liuzhou, south China's Guangxi Zhuang Autonomous Region, Aug. 12, 2021. (Photo by Li Hanchi/Xinhua)

DEVELOPMENT DIVIDEND MAGNET

China's mega-market volume, policy dividends, and improved business environment also win over the long-term investment commitment from multinationals. The resilience of foreign investment has defied earlier expectations that multinationals would withdraw from the country.

In the first half of the year, the European Union saw its actual investment in China grew 10.3 percent year on year. Foreign investments from countries along the Belt and Road and the Association of Southeast Asian Nations into the Chinese mainland jumped 24.7 percent and 23.7 percent, respectively, during the January-November period.

As China accelerated industrial restructuring, more foreign investment flowed into modern service industries and advanced manufacturing industries, according to Tu Xinquan, a professor with the China Institute for WTO Studies at the University of International Business and Economics.

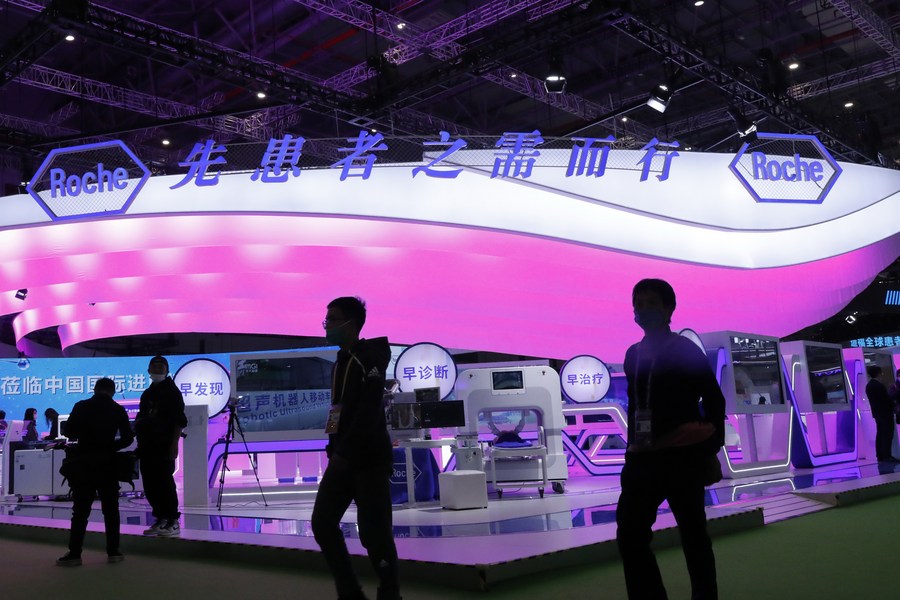

In May, Roche, a Switzerland-based global healthcare company, invested over 200 million yuan in helping incubate and support innovative Chinese medical enterprises.

Automation giant Honeywell International also signed cooperation agreements with more than 20 Chinese enterprises on green and low-carbon development, advanced manufacturing, and digitalization at the China International Import Expo.

China actively promotes green and low-carbon transformation and brings broad development opportunities to multinational enterprises, said Steven Lien, president of Honeywell China and Aerospace Asia Pacific.

Photo taken on Nov. 9, 2021 shows the booth of Roche of Switzerland at the 4th China International Import Expo (CIIE) in east China's Shanghai. (Xinhua/Zhang Yuwei)

Photo taken on Nov. 9, 2021 shows the booth of Roche of Switzerland at the 4th China International Import Expo (CIIE) in east China's Shanghai. (Xinhua/Zhang Yuwei)

ROSY PROSPECTS AHEAD

The Latest forecasts of China's economic growth for 2022 from major international organizations have manifested their confidence in its economy.

The International Monetary Fund forecasts that China's economy will grow 5.6 percent next year, 0.7 percentage points higher than global economic growth. The World Bank's prediction came in at 5.1 percent.

At the tone-setting Central Economic Work Conference earlier this month, China's top policymakers urged proactive efforts to align with the high-standard international economic and trade rules, deepening reform via high-level opening-up, and boosting high-quality development.

The meeting also stressed promoting institutional opening-up and attracting more investment from multinational companies.

German carmaker BMW recently announced its upgraded strategy for the Chinese market.

"Next year, three new or upgraded plants will open in Shenyang and Zhangjiagang. We will soon be launching the second BMW electric battery vehicle from Shenyang," said Nicolas Peter, member of the board of management of BMW AG responsible for finance and China affairs.

He believed that the move would enhance China's position as one of BMW Group's top three new energy vehicle production bases globally.